6800+ Happy Customers

6800+ Happy Customers

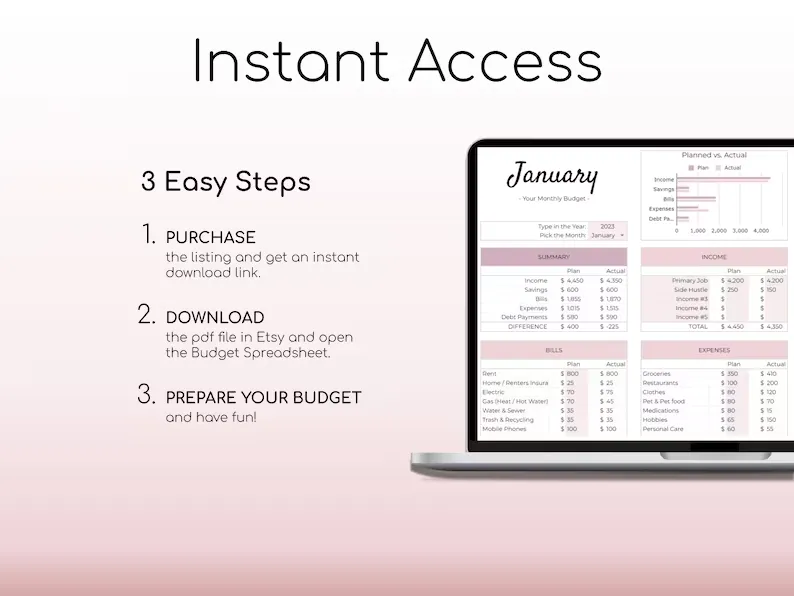

Instant Accessible Sheets

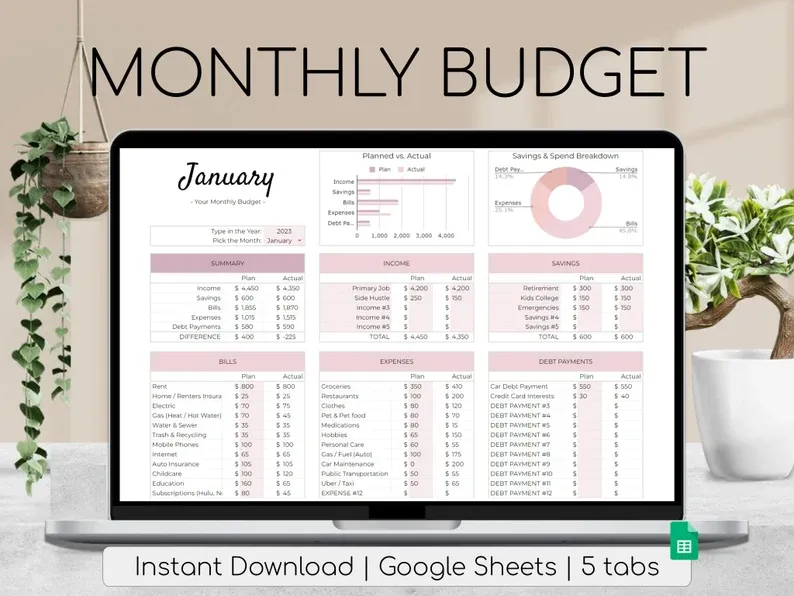

Monthly Budget Worksheet

A professional template to manage your income and spending

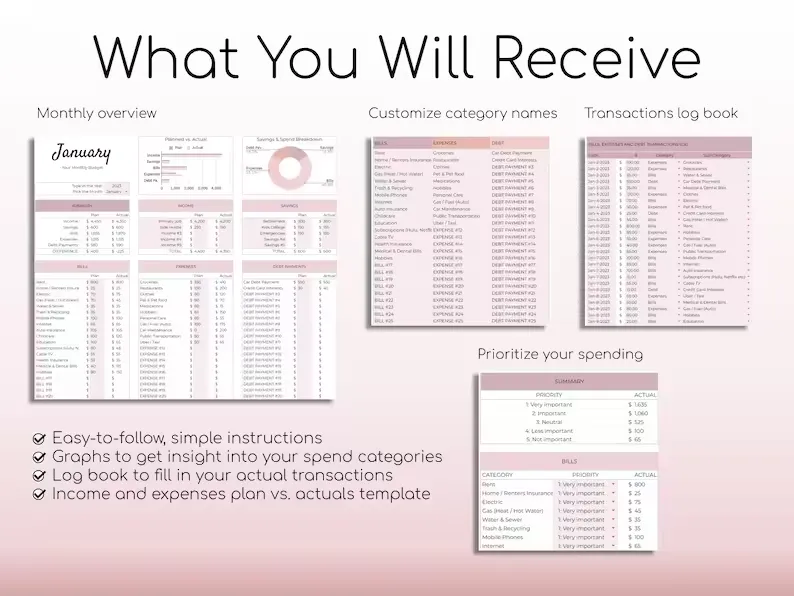

Step-by-step instructions on how to use the file

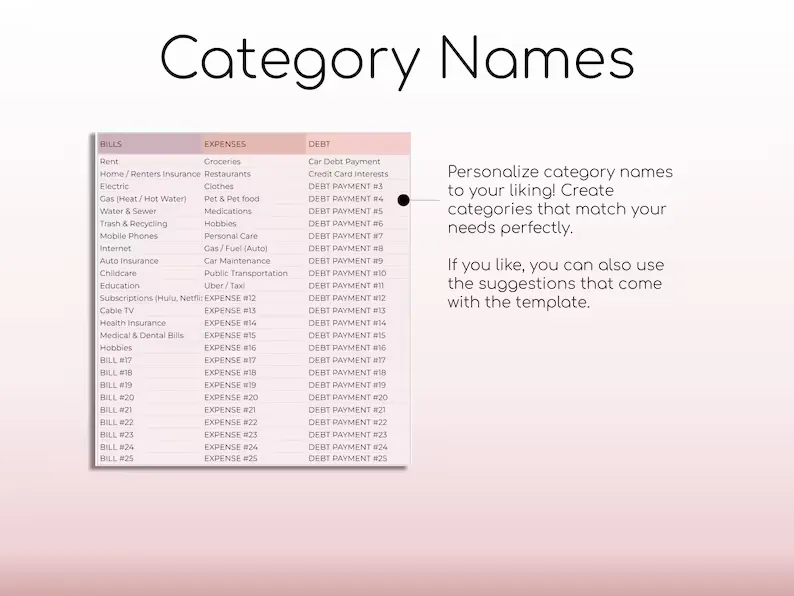

Possibility to create your own category names or use the suggestions provided

Monthly template that you can reuse for lifetime

Track income expectation

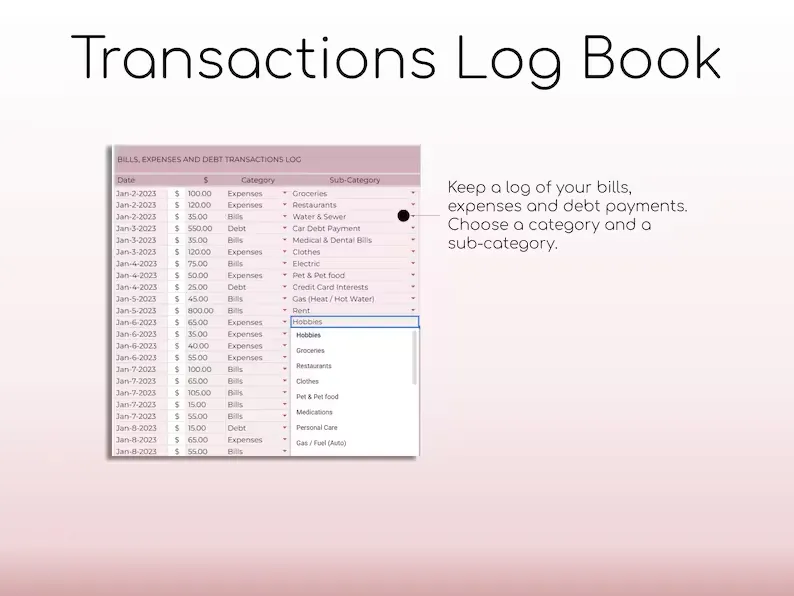

Track planned bills, expenses and debt payments

Helpful charts and graphs to visualize your finances

What is Monthly Budget Worksheet?

Hey there! Are you ready to take control of your finances and pave the way to a brighter financial future? Managing your money wisely is crucial for financial stability and success.

Luckily, I have an amazing tool to share with you today that will make the process a whole lot easier. It's called the Monthly Budget Planner Worksheet.

We have examined an immense amount of budgeting templates. With all those learning in mind, I designed this budget spreadsheet. We believe it to be the most adaptable and user-friendly budget spreadsheet ever created!

The colour scheme of this spreadsheet is blush pink to make budgeting a little more enjoyable. Simple to follow instructions are included to assist you in getting started. Join the growing number of our satisfied clients! We are confident that you will adore our products as so many others have. We are here to simplify your life. We provide a complete money back guarantee, so if for any reason you're not happy with your purchase, simply let us know and we'll make it right!

This little gem will help you keep track of your income, expenses, and savings goals, all in one place. With its help, you can navigate your financial journey and achieve your goals with confidence. So, let's dive in and explore the wonders of the Monthly Budget Worksheet.

Order Your Monthly Budget Worksheet for Just $5.00

Offer Valid For Today Only

Order Your Monthly Budget Worksheet for Just $5.00

Offer Valid For Today Only

Why Use a Monthly Budget Worksheet?

Get Financially Savvy: Imagine having all your income and expenses neatly organized in one place.

The Monthly Budget Worksheet provides a clear overview of where your money is going. It allows you to see your spending patterns, identify areas for improvement, and make smarter financial decisions.

With this tool, you can become more aware of your financial health and gain control over your money.

Conquer Your Goals: We all have financial goals we want to achieve, whether it's paying off debt, saving for a dream vacation, or building an emergency fund.

The budget planner excel sheet is your secret weapon to conquer these goals. It enables you to set clear targets, track your progress, and make adjustments along the way.

By keeping an eye on your income and expenses, you can stay motivated and focused on reaching your financial milestones.

Tame Your Spending: Do you ever wonder where all your money goes each month?

The Monthly Budget Planner Spreadsheet helps you categorize and monitor your expenses, allowing you to identify areas where you tend to overspend. By setting specific limits for each spending category, you can make informed choices and stay in control of your finances.

With this tool, you can ensure that your hard-earned money is being allocated effectively and efficiently.

Features of Monthly Budget Planner Worksheet

Easy-to-Use Interface: The Printable Monthly Budget Planner Worksheet offers a user-friendly interface, making it accessible to individuals of all levels of technical expertise. You don't need to be an Excel wizard to navigate and utilize its features effectively.

Customizable Expense Categories: The spreadsheet allows you to personalize the expense categories to match your specific needs and priorities. Whether you want to include additional categories or modify existing ones, you have the flexibility to tailor the spreadsheet to your unique financial situation.

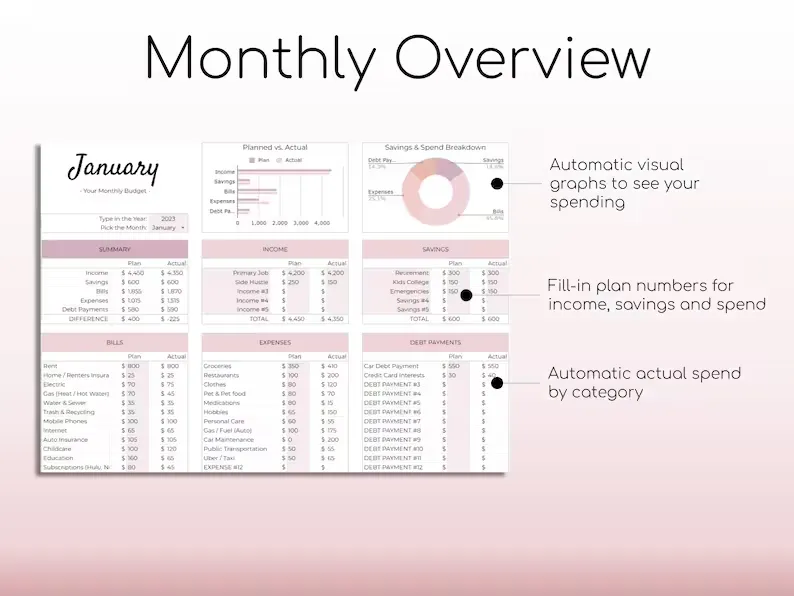

Income and Expense Tracking: With designated sections for income and expenses, the spreadsheet helps you keep track of your financial inflows and outflows. By regularly inputting your income and expenses, you can maintain an accurate record of your financial transactions.

Budget Allocation: The monthly budget worksheet enables you to allocate a budgeted amount for each expense category based on your financial goals. This feature helps you set spending limits and prioritize your expenditures according to your needs and priorities.

Visual Representations: The spreadsheet offers visual representations, such as charts and graphs, to provide a clear overview of your financial data. These visual aids make it easier to analyze your spending patterns, track your progress, and identify areas for improvement.

Real-Time Updates: By inputting your expenses and income promptly, the spreadsheet allows you to track your finances in real-time. You can see the impact of your transactions immediately and make adjustments accordingly.

Expense Comparison: The spreadsheet enables you to compare your actual expenses against your budgeted amounts. This feature provides insights into areas where you may be overspending or underspending, allowing you to make informed adjustments.

Goal Celebrations: The spreadsheet provides the opportunity to celebrate your financial milestones. As you achieve savings goals or stay within your budgeted amounts, you can use the spreadsheet to mark and acknowledge your achievements, keeping you motivated along your financial journey.

Printable Format: The budget planner spreadsheet can be easily printed out, offering a physical copy of your financial data. This feature allows you to have a tangible reference and serves as a backup in case of technological issues.

Ongoing Analysis: With regular updates and consistent tracking, the spreadsheet facilitates ongoing analysis of your financial health. You can review your spending habits, identify trends, and make informed decisions to improve your financial well-being.

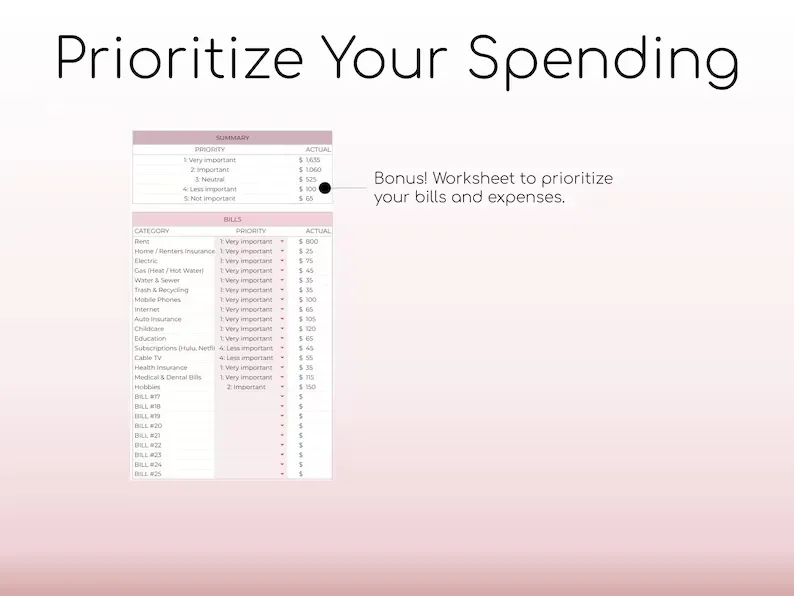

Bonus: You'll get a worksheet to prioritize your bills and expenses as bonus with this purchase.

Easy-to-Use Interface: The Monthly Budget Planner Spreadsheet offers a user-friendly interface, making it accessible to individuals of all levels of technical expertise. You don't need to be an Excel wizard to navigate and utilize its features effectively.

Customizable Expense Categories: The spreadsheet allows you to personalize the expense categories to match your specific needs and priorities. Whether you want to include additional categories or modify existing ones, you have the flexibility to tailor the spreadsheet to your unique financial situation.

Income and Expense Tracking: With designated sections for income and expenses, the spreadsheet helps you keep track of your financial inflows and outflows. By regularly inputting your income and expenses, you can maintain an accurate record of your financial transactions.

Budget Allocation: The budget planner spreadsheet enables you to allocate a budgeted amount for each expense category based on your financial goals. This feature helps you set spending limits and prioritize your expenditures according to your needs and priorities.

Visual Representations: The spreadsheet offers visual representations, such as charts and graphs, to provide a clear overview of your financial data. These visual aids make it easier to analyze your spending patterns, track your progress, and identify areas for improvement.

Real-Time Updates: By inputting your expenses and income promptly, the spreadsheet allows you to track your finances in real-time. You can see the impact of your transactions immediately and make adjustments accordingly.

Expense Comparison: The spreadsheet enables you to compare your actual expenses against your budgeted amounts. This feature provides insights into areas where you may be overspending or underspending, allowing you to make informed adjustments.

Goal Celebrations: The spreadsheet provides the opportunity to celebrate your financial milestones. As you achieve savings goals or stay within your budgeted amounts, you can use the spreadsheet to mark and acknowledge your achievements, keeping you motivated along your financial journey.

Printable Format: The budget planner spreadsheet can be easily printed out, offering a physical copy of your financial data. This feature allows you to have a tangible reference and serves as a backup in case of technological issues.

Ongoing Analysis: With regular updates and consistent tracking, the spreadsheet facilitates ongoing analysis of your financial health. You can review your spending habits, identify trends, and make informed decisions to improve your financial well-being.

Bonus: You'll get a worksheet to prioritize your bills and expenses as bonus with this purchase.

Monthly Budget Worksheet FAQs?

Why should I use a monthly budget planner excel worksheet instead of a traditional budgeting method?

A monthly budget planner worksheet offers several advantages over traditional budgeting methods. It provides a centralized and organized platform to track your income, expenses, and savings goals. With its automated calculations and easy-to-read format, a spreadsheet simplifies the budgeting process, provides a clear overview of your financial health, and enables you to make informed decisions about your money.

What if I overspend in a particular category? How can the blank monthly budget worksheet help me?

If you find yourself overspending in a specific category, this personal monthly budget template can act as a wake-up call. By visually seeing the impact of overspending, you can make necessary adjustments to get back on track. Consider redistributing funds from other categories or finding ways to cut back in the overspent category. The spreadsheet's visual representations and tracking features make it easier to identify areas where you can make improvements.

Can this monthly budget worksheet template help me save money?

Absolutely! One of the primary goals of this budget worksheet template is to help you save money. By setting specific budget amounts for different expense categories, you can ensure that you allocate funds for savings goals. The spreadsheet allows you to track your progress towards these goals and make adjustments as needed. It serves as a constant reminder to prioritize savings and provides a clear visual representation of your saving achievements.

Can I customize the categories in the budget planner spreadsheet to match my specific needs?

Absolutely! The beauty of this budget planner worksheet is its flexibility. You have the freedom to customize the expense categories to align with your unique lifestyle and financial priorities. Whether you want to include categories like pet expenses, hobbies, or subscriptions, the spreadsheet can be tailored to suit your needs.

How Will I Receive The Worksheet?

Once you place the order, you'll be instantly redirected to the worksheets link and you can use them instantly. You'll also get the link on the registered email.

Can I use the budget planner template for long-term financial planning?

While the blank monthly budget template primarily focuses on monthly budgeting, it can certainly be used for long-term financial planning. By tracking your income, expenses, and savings goals consistently over time, you can gain insights into your financial trends and make informed decisions about your long-term financial plans. The spreadsheet's visual representations and progress tracking features provide a valuable tool for monitoring your financial journey.

Regular Price: $10.00

Only For: $5.00

Copyright © 2023 - Monthly Budget Worksheet

Copyright © 2023 - Monthly Budget Worksheet